Robert Cowen Investments (RCI) was started in 1982 by Robert Cowen in order to manage private client assets, and is now positioned as a niche investment house, specialising in family wealth management. RCI has grown and expanded our business over the past four decades. We started with a handful of clients and now serve over 200 families across many generations. For some, we are looking after the fourth generation of individuals who originally started out with us in 1982! The size of the portfolios varies, ranging from R1 million to R500 million. RCI prides itself on being able to provide a comprehensive investment, wealth management, wealth structuring, administration and accounting service with a great deal of emphasis on personal service. Our dedicated team of experts is committed to providing personalized solutions that align with your family’s values, objectives, and legacy aspirations. With our extensive experience and deep understanding of the ever-changing financial and regulatory landscape, we are here to guide you at every stage of your financial journey.

Welcome

About Us

From 1982 until 1996

South African financial institutions could only invest in local assets and were not allowed to invest offshore. Our focus was to invest in shares listed on the Johannesburg Stock Exchange unless clients had a need for income. Equities have been the only asset class to outperform inflation on a long-term basis.

1997 Onwards: Sending Funds Offshore

After the advent of democracy, South African exchange controls were relaxed in 1997 and we were allowed to invest up to R250,000 of clients’ capital offshore per year. This exchange control allowance is now R10 million per year. This has enabled the South African investing public to increase their allocation to global investments over time, thereby benefiting from faster-growing economies and more innovative companies. Our investment philosophy closely follows our mantra, ‘live in the sun, invest in the shade’ and we advocate transferring a significant amount of a client’s investments offshore.

2001 Onwards: Introduction of Unit Trusts

In 2001, capital gains tax was introduced in South Africa and we adopted our investment approach to deal with this. We established our first unit trust, the RCI Flexible Managed Fund in 2003. Any purchases or sales inside a unit trust are not subject to capital gains tax and so the fund is able to trade without considering the tax effects for the client. We now have unit trusts across the entire risk spectrum at our disposal that provide tax-friendly solutions.

2011 Onwards: Greylisting and Increased Compliance & Regulation

In the early 2010s, Common Reporting Standards and the Foreign Account Tax Compliance Act were introduced to standardize and enforce the sharing of all financial information between jurisdictions. Following South Africa’s greylisting, the compliance and regulatory burden has become even more onerous. We now have approximately R5.9 billion in assets under management, with 24% invested locally and 76% invested offshore. Given that the situation on the ground in South Africa persists, “live in the sun and invest in the shade” will remain central to our investment approach, despite the additional time and cost involved in complying with stricter guidelines.

2015 Onwards: Anchor Becomes Majority Shareholder

We are a subsidiary of Anchor, which now owns 100% of RCI. RCI provides family office expertise to the Anchor Group and our investment processes are highly integrated. We know enough to know when we don’t know enough and consequently have assembled a set of highly skilled specialists offering legal, exchange control and wealth structuring services. These offerings combined with our specialist family office services, led to the establishment of Anchor Succession, which started in 2022. Anchor Succession is involved with all matters relating to trusts, wills and estates.

Our Investment Strategy

At RCI, we believe that, even more important than setting your financial goals is deciding how you will get there and sticking with the plan. An effective asset allocation strategy is the starting point in your journey to financial success. We recognise that everyone is different and our aim is to prepare a plan with you that takes proper account of your current financial position, personal family situation, risk profile, financial goals, and time horizon. We consider global diversification an important part of managing risk over the long-term. We seek to allocate among equities, bonds, real estate, alternative investments and cash, both locally and offshore, to design bespoke portfolios that align with your objectives and will be there to proactively refine that plan with you as things change. In seeking to ensure your wealth grows in real terms (after inflation, in other words), we believe in the power of offshore equities to capture global growth opportunities and produce superior long-term capital growth in rands. Whether you’re seeking capital preservation, income generation, or long-term growth, our asset allocation strategies are designed to meet your unique requirements. Contact us today to learn how our expertise in crafting customized portfolios can help you achieve your financial goals.

Our objective is to deliver real (meaning above inflation) after-tax growth in our clients’ wealth over the long term. To achieve this, we invest in companies that meet our quality investment criteria. These are typically companies that produce products that people use regardless of the economic cycle. We tend to avoid companies that are highly capital-intensive and favour businesses that are competitive globally but listed in markets that demand strong governance and transparency.

For us, quality traits we seek in the companies in which we invest include:

- Businesses that have demonstrated an ability to sustainably generate a superior return on their operating capital;

- Businesses that have a clear grow path ahead and thus have the opportunity to compound growth through reinvestment of the cash they generate;

- Attributes or competitive advantages that are difficult for others to replicate – competitive moats;

- Strong cash generation and limited reliance on debt;

- Able to cope well with technological change and creative destruction;

- Business models that are not dependent on government policy or regulation.

We acknowledge that such companies more often than not trade at valuations that are higher than the broader market, due to their superior fundamentals. We aim to be patient in order to take advantage of opportunities to acquire positions at acceptable levels and then hold them for a long time. This ensures our clients benefit from the power of compound growth over the long term, while the drag from trading costs and tax is minimised.

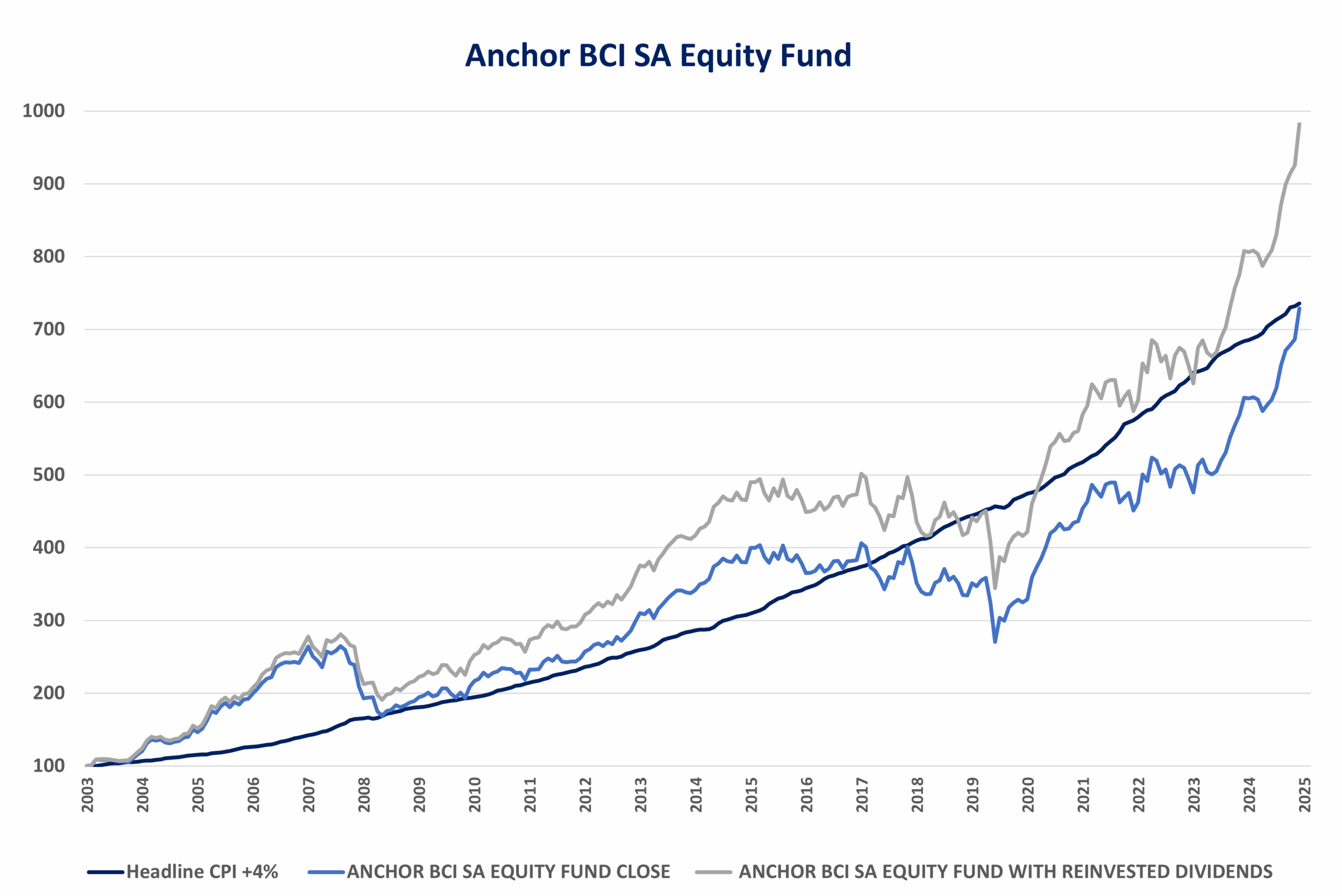

Anchor BCI SA Equity Fund

The Anchor BCI SA Equity Fund closed October at 686.59, up 1.20% for the month and up 19.35% for the last 12 months.

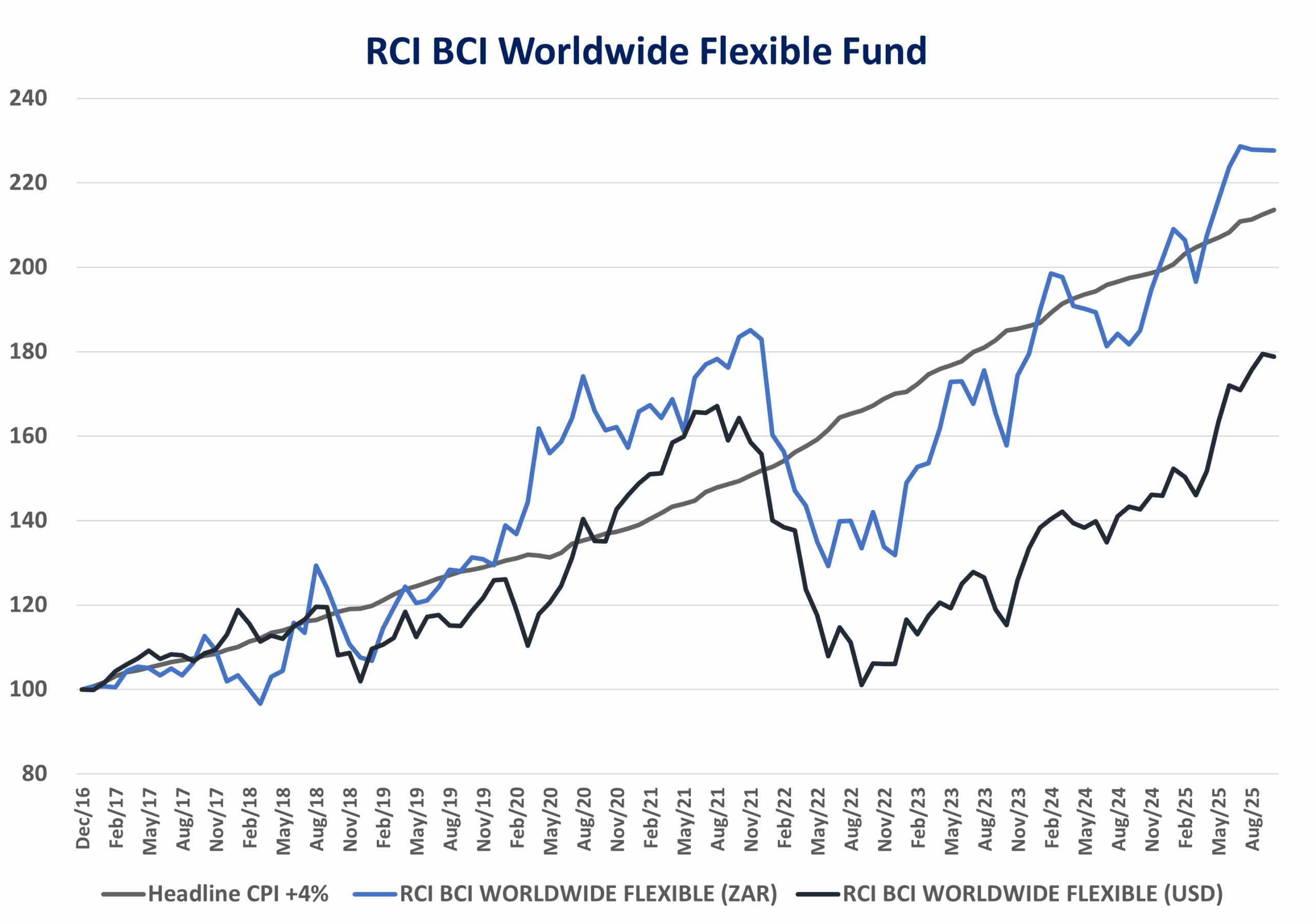

RCI BCI Worldwide Flexible Fund

The RCI BCI Worldwide Flexible Fund closed October at 227.67, down 0.03% for the month and up 23.08% for the last 12 months.

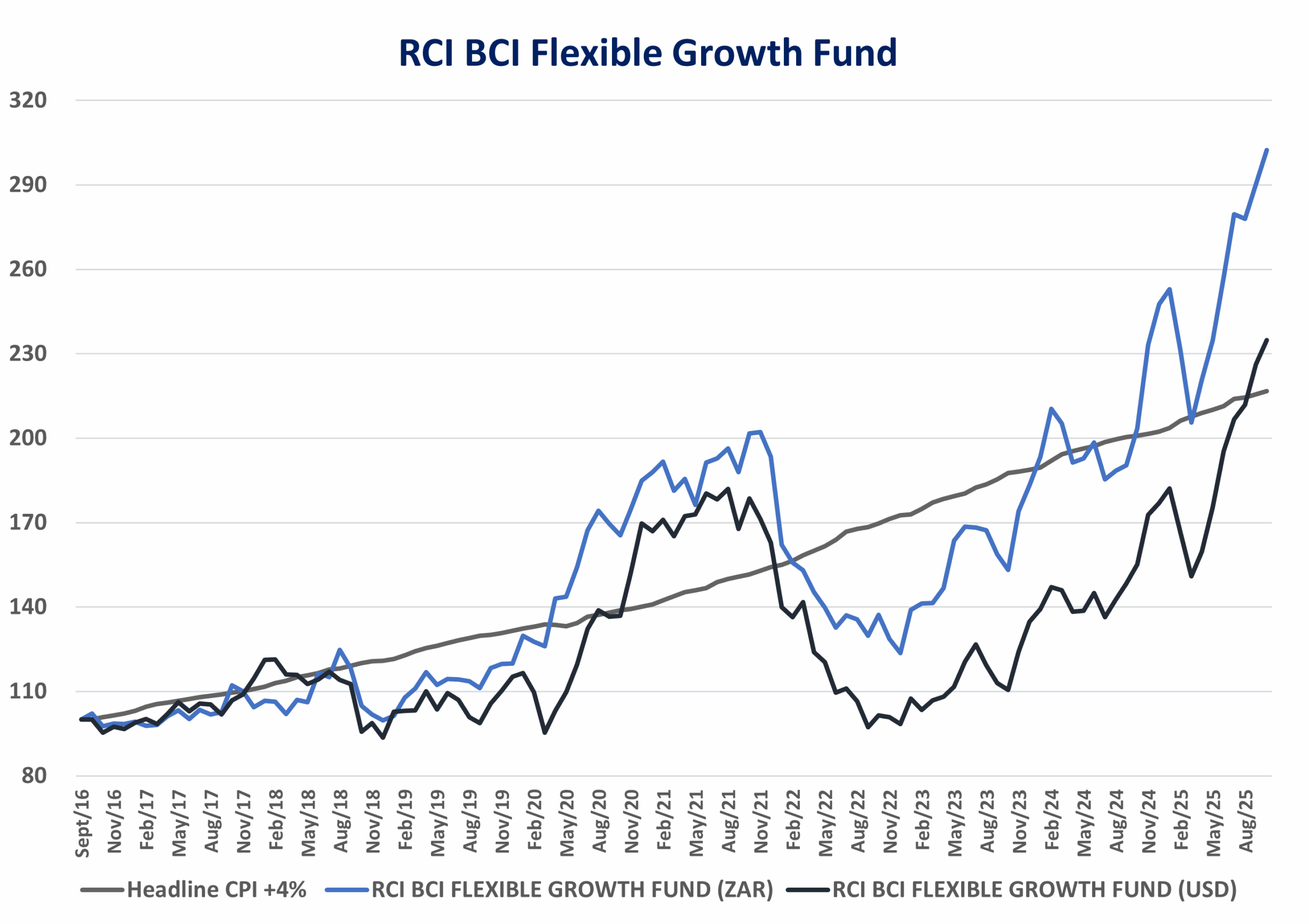

RCI BCI Flexible Growth Fund

The RCI BCI Flexible Growth Fund closed October at 302.34, up 4.16% for the month and up 48.55% for the last 12 months.

Specialised Investment Services

- Bespoke Portfolios

- Unit Trusts

- Retirement Products

- Anchor Succession (Trusts, Wills & Estates)

- Offshore Structuring

At RCI, we specialize in tailoring bespoke share portfolios for our clients’ needs. In addition to this we manage a variety of different unit trusts that are managed with similar investment strategies (albeit some with a local focus and others with an offshore focus).

The local bespoke share portfolios are well diversified, covering a variety of different industries. A particular focus is placed on companies that produce products that people have to use regardless of the economic cycle and therefore are able to exhibit reliable earnings streams with which they can pay you an income from. We avoid cyclical and capital intensive businesses. Most of the chosen companies offer, either, good capital growth prospects, or rand hedge characteristics, good income yields, or a combination of all three traits. Typically, we focus the bulk of the portfolio on listed companies with a high ROCE (return on capital employed) and high free cash flow so they can produce you good income growth over time that is reliable regardless of what happens to your capital. A fundamental part of our clients future returns is depenedent on the a growing dividend stream that is paid to them. Over time, this can be used to draw down on, or, if not drawn out, compound.

Our view of the markets and the shares chosen for the portfolio is constantly changing albeit we do have a long term strategy in place. Our investment decisions remain flexible and are adjusted when appropriate.

In general, we aim to construct portfolios that exhibit the following characteristics:

- Companies generating large amounts of free cash flow and high returns on capital employed

- Both growth shares and dividend paying shares that achieve your income requirements.

- Large and medium cap shares that are in the top 100 on the JSE but mostly the top 40.

- Companies with attractive balance sheets and well established management teams.

- Rand hedge shares to protect against the weakening rand over the long term.

- Exposure to multiple industries and demographics.

- Limited exposure to resources and commodities.

- Exposure the growing middle class.

RCI currently offers a range of unit trust products from Anchor Capital. We have three different unit trust products managed directly by the RCI investment team:

RCI BCI WORLDWIDE FLEXIBLE GROWTH FUND (L)

INVESTMENT OBJECTIVE

A moderate to aggressive risk profile portfolio that aims to deliver high long-term capital growth at a reasonable level of risk.

INVESTMENT POLICY & PHILOSOPHY

Subject to a minimum equity exposure of 40% of the portfolio’s total assets, the manager shall have the maximum flexibility to vary assets between the various markets, asset classes and countries to reflect the changing economic and market conditions. The portfolio will include, amongst others, quality equity securities with high long-term earnings growth potential. The portfolio may invest in global and local equity securities, interest-bearing securities, property shares, property-related securities, preference shares, money market instruments, non-equity securities and assets in liquid form. The fund does not ascribe to market timing but rather focuses on businesses that are able to provide good long-term cash generation potential while allowing for positive operating leverage over time. Offshore equity exposure is preferred to give investors exposure to innovative technologies and services. Some of the themes include the internet, e-commerce, cloud computing, software as a service, cyber security, payments, fintech and streaming.

RCI BCI WORLDWIDE FLEXIBLE FUND (A)

INVESTMENT OBJECTIVE

A worldwide multi-asset flexible portfolio that aims to deliver a high long-term total return.

INVESTMENT POLICY & PHILOSOPHY

The focus of the portfolio is direct investment in high quality offshore equities that are world leaders in their industries, with emphasis on businesses with high Return on Capital Employed combined with excellent free cash flow generation. We tend to ignore whether or not a company pays a dividend as we usually prefer those businesses that reinvest earnings in their internal operations. We also tend not to chase short-term investment narratives and themes that could be trending in the market, as we would not want to reduce the quality of the portfolio for the sake of following the flavour of the month.

ANCHOR BCI SA EQUITY FUND (A)

INVESTMENT OBJECTIVE

A domestic general equity portfolio that aims to provide investors with high long-term capital growth.

INVESTMENT POLICY & PHILOSOPHY

The portfolio’s net equity exposure will be a minimum of 80% of the portfolio’s asset value. The portfolio’s investment universe consists of South African equity securities, preference shares, property shares and property related securities listed on exchanges, interest-bearing instruments as well as assets in liquid form. The focus of the portfolio is on investing in domestically listed companies that have an investment case that insulates them from SA’s difficult economic situation (strong multinational franchise, rand hedge, dominant local platform, or clear local expansion strategy for example); high confidence in improving Return on Capital Employed and excellent cash flow generation. Of those companies that pay a dividend we prefer businesses with a dependable and solid payment history.

One of the diverse wealth services Robert Cowen Investments offer is looking after client’s retirement funding. We are licensed through the FSCA (Financial Services Sector Authority) as both a Category 1 and Category II service providers in long term insurance products.

Retirement funds provide the following options:

Retirement annuities – which offer individuals a vehicle through which to make provision for retirement and provides tax relief on contributions

Living annuities – which provides members retiring from provident, pension or retirement annuities to receive regular income

Preservation Funds – Individuals, who are participants of a registered pension or provident fund and are in the process of leaving their employment, have the opportunity to preserve their retirement benefits via preservation funds until they retire. If funds are being transferred from a pension fund they will go into a pension preservation fund. Likewise a provident fund can be transferred into a provident preservation fund

Benefits of Robert Cowen Investments looking after your retirement funding include:

- Dependant on value of funds available, a share portfolio can be managed within the retirement funding

- Funds can be invested offshore through our service providers

- Our portfolio managers regularly check clients’ portfolios to ensure that growth is in line with client mandates and preferences

- Clients receive monthly statements of their investments and portfolio managers do regular reviews with clients

- Annually we check with all clients from a tax perspective to assess whether it would be prudent for clients to add to their current retirement annuities or to start a new retirement annuity to utilise the current tax reduction benefits in terms of taxation

We take pride in the ability to offer our clients a wide range of services to ensure a total package of wealth and portfolio management.

For further information on our retirement funding options, contact Christine Ulyate on (011) 591 0569 or christine@rcinv.co.za

Trusts

We are able to assume responsibility as Trustees of Trusts that are or have been established for our clients, through our independent Trust company, Apollo Trustees (Pty) Ltd, which Di Haiden represents. This covers the fiduciary and administrative responsibility assumed by Trustees as well as advising on the setting up of Trust Deeds and approval of Trusts by the Master. We run investment portfolios for the Trusts, provide accounting (which includes preparing the Financial Statements of the Trust) and administrative work, which involves the drawing up of resolutions and loan agreements etc., minute taking and distributions. We also keep up to date with current tax and trust legislation and liaise with clients regularly regarding distributions from Trusts, loans to and from Trusts etc.

Wills and Estate Planning

Over the years, we have gained experience in all aspects of our clients’ affairs, including estate planning. Typically, this covers whether there is a need for Trusts in the client’s overall structure, what the assets are which are included in their estates, what effect estate duty will have on the asset base upon a death and how to structure their investments going forward. We also review clients’ existing wills and organize for wills to be drawn up or re-drafted.

Content to be advised

Fund Updates

Stay up to date with our latest news.

Other Services

Robert Cowen Investments offers full administration and accounting services where trusts are involved. This includes trustee services and the administration involved therein. This covers the routine maintenance for trusts including minute books, organizing of trustees meetings, amendments to trust deeds etc.

A full accounting system is in place to record all transactions and produce the necessary annual financial accounts for trusts and individual clients. Statements are sent to the client monthly and include a transactions schedule and portfolio valuation

| Robert Cowen Investments | Fee percentage p.a. | RCI portion/rebate |

| RCI Advisory Fee | 1.25% | 1.25% |

| Brokerage | ||

| Local Brokerage Fee (% of the trade) - Anchor | 0.50% | 0.30% |

| Offshore Brokerage Fee (% of the trade) - SAXO | 0.50% | 0.35% |

| Broker Expenses | ||

| Offshore Quarterly Custody Fee - SAXO | US$ 25 | US$ 12.5 |

| Local DMA Platform Expenses | 0.15% | 0.00% |

| Anchor Monthly Share Portfolio Admin Fee | R40 | 0 |

| Anchor turn on Call Interest earned | 0.50% | 0.00% |

| Unit Trust Fees | ||

| Anchor BCI SA Equity Fund A* | 1.00% | 0.905% |

| Anchor BCI SA Equity Fund B ** | 0.095% | 0.00% |

| RCI BCI Worldwide Flexible Fund A* | 1.00% | 1.00% |

| RCI BCI Worldwide Flexible Fund B ** | 0.20% | 0.10% |

| RCI BCI Worldwide Flexible Growth Fund | 1.00% | 1.00% |

| RCI Global Fund | 1.25% | 1.25% |

| RCI Next Generation Exchange Traded Note | 0.60% | 0.25% |

| All Anchor Unit Trusts | Fund dependent | 0.75% of relevant management fee |

| Nedbank Charges | ||

| Monthly Account Fee | R12.00 | R0.00 |

| EFT Fee per payment | R5.00 | R0.00 |

| Annual Administration Fee (approx.) | R600.00 | R0.00 |

| Momentum Fees | ||

| Platform Administration Fees | 0.15% | 0.00% |

| First R1.5m | 0.50% | 0.00% |

| Amount above R5m | 0.15% | 0.00% |

| Additional access fee will apply on: | 0.15% | 0.00% |

| - Personal share portfolio | ||

| - International administration | ||

| - Momentum offshore capacity | ||

| - Traded Endowment Option | ||

| Transactional Fees | ||

| Investment switches online | R250 per switch | R0.00 |

| Immediate payment fee | R100 | R0.00 |

*The investment manager of Astoria, Anchor Capital Mauritius, earns a 1% asset management fee for direct investments and 0.5% fee for investments into funds by third parties. In turn Anchor Capital South Africa provides investment advisory services to Anchor Capital Mauritius and earns an advisory fee. Anchor Capital South Africa is the holding company of RCI, but RCI receives none of these fees.

All figures are exclusive of VAT.

RCI offer a full suite of cash services needs for private clients. These services include:

- Setting up and paying of any monthly drawing requirements as well as processing any ad-hoc cash requirements or third party payments (can take up to 4 working days)

- Paying of any monthly debit orders (DSTV, tracker services, medical aid, levies etc)

- Sending funds offshore – we utilise the services of Nedbank and Exchange 4 Free

- Transfers of cash between RCI managed accounts (Nedbank, PSG and Momentum)

All accounts are opened in the name of the client and any bank charges incurred for any of the above are for the client’s account.

Our Team

Contact Us

ROBERT COWEN INVESTMENTS

25 Culross Road

Bryanston

Sandton

2191

South Africa

MAILING ADDRESS

P.O. Box 784

Saxonwold

2132

South Africa

CONTACT NUMBERS

Office: 011 591 0585